Not known Details About Neutralizing Pet Odors

Wiki Article

The smart Trick of Neutralizing Pet Odors That Nobody is Discussing

Table of ContentsWhat Does Neutralizing Pet Odors Mean?How Neutralizing Pet Odors can Save You Time, Stress, and Money.Getting My Neutralizing Pet Odors To WorkSome Known Incorrect Statements About Neutralizing Pet Odors

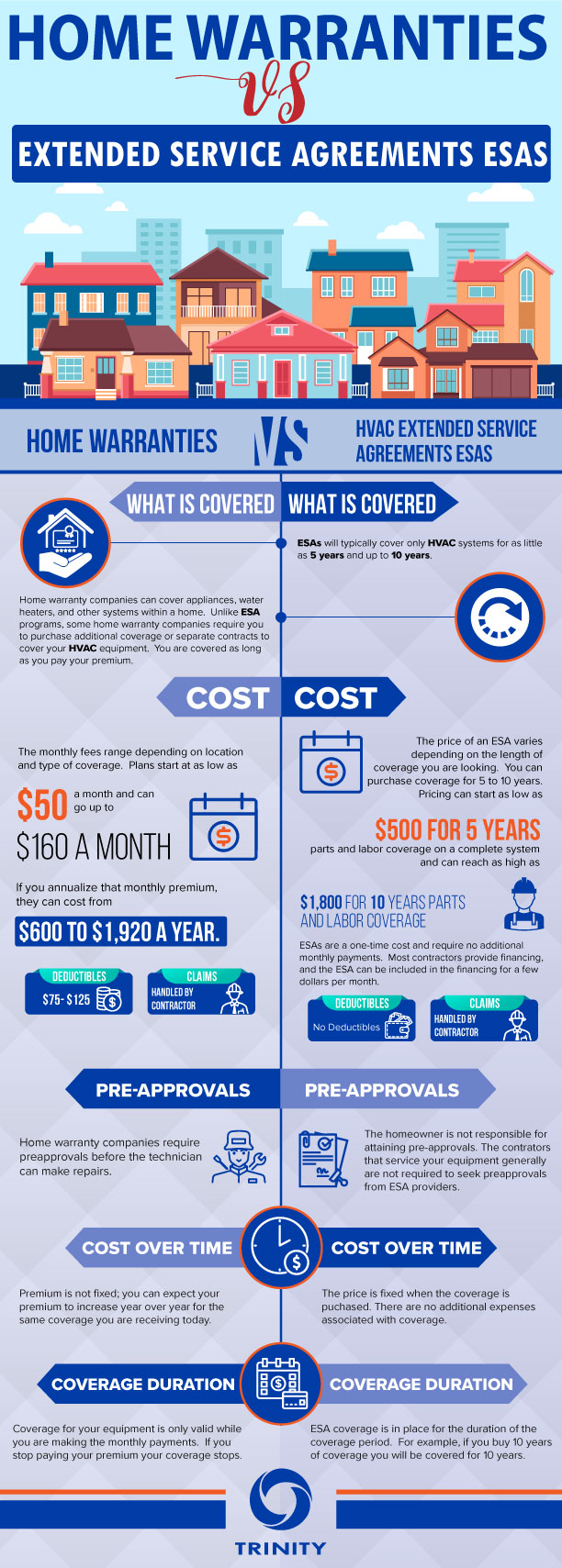

Have you ever before wondered what the difference was between a home warranty as well as house insurance coverage? Both safeguard a home and a home owner's wallet from pricey repair services, but what exactly do they cover? Do you require both a residence service warranty as well as residence insurance coverage, or can you obtain just one? Every one of these are outstanding concerns that many home owners ask.

What is a house service warranty? A home service warranty secures a residence's inner systems and appliances. While a home service warranty agreement is comparable to house insurance, especially in exactly how a home owner utilizes it, they are not the exact same point. A property owner will certainly pay a yearly premium to their home service warranty company, usually between $300-$600.

If the system or appliance is covered under the property owner's house guarantee plan, the home warranty company will send a professional who specializes in the repair of that particular system or device - neutralizing pet odors. The home owner pays a level rate service call cost (generally in between $60-$100, depending upon the house warranty company) to have the contractor come to their house as well as identify the issue.

Our Neutralizing Pet Odors PDFs

What does a home service warranty cover? A home service warranty might also cover the bigger appliances in a residence like the dishwashing machine, stove, fridge, clothes washing machine, and also clothes dryer.If a commode was leaking, the home warranty business would certainly pay to deal with the bathroom, but would not pay to repair any water damage that was caused to the structure of the home because of the leaking toilet. The good news is, it would certainly be covered by insurance. What is home insurance? If a home owner has a home mortgage on their residence (which most property owners do) they will be needed by their home mortgage lender to buy home insurance policy.

Home insurance policy might also cover clinical expenditures for injuries that individuals sustained by being on your home. A house owner pays an annual premium to their homeowner's insurer. Typically, this is somewhere in between $300-$1,000 a year, depending on the plan. When something is harmed by a catastrophe that is covered under the house insurance coverage, a home owner will call their home insurer to submit a claim.

:max_bytes(150000):strip_icc()/AFCHomeClubforonlinequotingAmericas1stChoice-5a83096943a1030037423d8f-1-083605c6c9e2413d83a66c98dced822b.png)

Excitement About Neutralizing Pet Odors

What is the Difference In Between House Warranty and House Insurance A home warranty agreement and also a residence insurance coverage operate in comparable means. Both have an annual costs and an insurance deductible, although a residence insurance coverage premium and insurance deductible is commonly much more than a house warranty's. The major differences between residence warranties and also home insurance are what they cover.One more difference between a residence warranty as well as residence insurance is that residence insurance is normally needed for home owners (if they have a mortgage on their house) while a residence warranty plan is not required - neutralizing pet odors. A residence guarantee as well as residence Read Full Report insurance coverage give security on different parts of a residence, and also with each other they can safeguard a home owner's budget plan from costly repairs when they undoubtedly turn up.

If there is damages done to the structure of your house, the owner will not need to pay the high costs to repair it if they have house insurance policy. If the damage to the residence's structure or house owner's items was produced by a malfunctioning appliances or systems, a home warranty can help to cover the costly repair work or replacement if the system or appliance has stopped working from normal wear as well as tear.

Neutralizing Pet Odors - An Overview

"Nonetheless, the more systems you include, such as swimming pool insurance coverage or an additional heating unit, the higher the cost," she claims. Adds Meenan: "Costs are usually flexible too." Apart from the annual cost, property owners can expect to pay typically $100 to $200 per solution call go to, relying on the sort of agreement you get, Zwicker notes.Residence warranties don't cover "things like pre-existing problems, animal infestations, or remembered items, explains Larson. This is the time to take a close check out your insurance coverage because "the exemptions differ from program to program," says Mennan."If people don't check out or recognize the insurance coverages, they may wind up thinking they have protection for something they do not."Testimonial insurance coverages and exclusions during the "cost-free appearance" period.

"We paid $500 to authorize up, and after that needed to pay an additional $300 to clean up the main drain line after a shower drainpipe backup," states the Sanchezes. With $800 out of pocket, they believed: "We didn't gain from the house service warranty whatsoever." As a young pair in another residence, the Sanchezes had a difficult experience with a house guarantee.

When the specialist wasn't pleased with a reading he obtained while evaluating the go right here furnace, they say, the firm would not concur to insurance coverage unless they paid to change a $400 part, which they did. While this was the Sanchezes experience years earlier, Brown verified that "evaluating every major device prior to supplying protection is not a market requirement."Constantly ask your supplier for clearness.

Report this wiki page